Este artículo presentará resultados de análisis de datos que analizan el uso total de ingredientes del alimento, la composición nutricional de la dieta y el desempeño anual promedio de las empresas brasileñas de pollos de engorde que participan en Agri Stats de 2017 a 2021.

Brasil es el mayor exportador de carne de pollo y el segundo productor del mundo. La organización industrial, el marketing, el personal, el clima y las decisiones sobre nutrición son fundamentales para el éxito actual y el crecimiento más rápido de la producción avícola brasileña en comparación con otros países.

Las condiciones actuales del mercado de cereales son difíciles en todo el mundo. Comprender cómo se han utilizado los alimentos, observar la variabilidad en la energía dietética y los niveles nutricionales en toda la industria avícola brasileña y conectar esta información con los resultados del rendimiento en vivo puede ayudar a visualizar las decisiones nutricionales tomadas para enfrentar estos desafíos económicos y la eficacia de sus estrategias. implementación.

En los últimos cinco años, el costo de producción de pollo vivo aumentó aproximadamente un 135%, debido principalmente al mayor precio de los granos.

- La alimentación de pollos de engorde representa alrededor del 70% del costo total de producción en Brasil;

- Sin embargo, poco se puede hacer respecto de los precios de los cereales en el momento de las negociaciones, y

- es necesario mantener el foco en la eficiencia operativa para controlar los gastos a través de la eficiencia zootécnica y nutricional.

Este artículo presentará resultados de análisis de datos que analizan el uso total de ingredientes del alimento, la composición nutricional de la dieta y el desempeño anual promedio de las empresas brasileñas de pollos de engorde que participan en Agri Stats de 2017 a 2021.

Los datos indicaron que aumentar la energía dietética resultó ser una estrategia eficaz para reducir el consumo de alimento y mejorar la conversión alimenticia. Las empresas brasileñas de pollos de engorde mantuvieron la energía metabolizable en alrededor de 3140 kcal/kg, en promedio, en todas las dietas utilizadas en un ciclo productivo (Figura 1).

Figura 1. Energía metabolizable dietética media y consumo de soja entera y aceite de soja en dietas de pollos de engorde entre 2017 y 2021.

Al mismo tiempo, hubo un aumento del 160 % en la utilización de soja entera y una reducción del 44 % en el consumo de aceite de soja de 2017 a 2021.

- La soja entera con niveles de energía más altos que las harinas de soja permitió mantener el nivel de energía de estas dietas sin utilizar aceite de soja.

- El precio por tonelada de aceite de soja aumentó aproximadamente un 150%, pasando de R$ 2.035,00 en 2017 a R$ 5.166,00 en 2021, precio que en diciembre de 2022 equivale aproximadamente a US$ 981.

| La escasa oferta de la oleaginosa en EE.UU. y el retraso en la cosecha en Brasil provocaron este precio de mercado. |

Los precios de la soja han aumentado a lo largo de los años, llegando a 2022 con un valor récord de R$ 200,00 por saco (60/kg) o R$ 3.333 por tonelada métrica, lo que equivale aproximadamente a US$ 632. En consecuencia, la tendencia en la industria fue disminuir el consumo de soja y sus coproductos en la alimentación de pollos de engorde desde 2021.

En la industria de piensos a nivel mundial, existe una tendencia a reducir la proteína cruda en las dietas de los pollos de engorde para mitigar los impactos económicos y ambientales del exceso de aminoácidos.

- Los perfiles de aminoácidos equilibrados para alcanzar niveles óptimos mejoran la eficiencia de los pollos de engorde en la utilización del nitrógeno para la síntesis de proteínas y disminuyen el gasto de energía para excretar el exceso de nitrógeno.

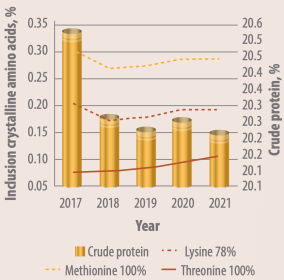

Así, se observó que la industria brasileña de pollos de engorde redujo los niveles promedio de proteína cruda en las dietas hasta en un 3% (Figura 2).

Figura 2. Nivel promedio de proteína cruda e inclusión de aminoácidos cristalinos en dietas de pollos de engorde en Brasil.

Sin embargo, dado que la genética actual de los pollos de engorde exige niveles más altos de aminoácidos debido a su mejor tasa de deposición de proteínas, la inclusión de aminoácidos cristalinos en las dietas de los pollos de engorde aumentó ligeramente en la industria brasileña.

Incluso con el mayor tipo de cambio [registro] del dólar estadounidense respecto del real brasileño impulsando los precios de las fuentes de aminoácidos cristalinos, en los últimos años se observó una mayor inclusión de lisina, metionina y treonina.

Al igual que la energía y las proteínas, el fósforo es uno de los nutrientes más caros para la producción de piensos. El aumento del coste de las fuentes de fósforo, principalmente en su forma inorgánica, ha provocado una disminución de los niveles dietéticos de este mineral.

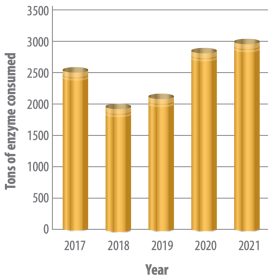

En el mismo contexto, en los últimos cinco años se ha vuelto popular intentar mitigar los efectos antinutricionales del fitato y mejorar la disponibilidad de fósforo utilizando superdosis de fitasa o mezclas enzimáticas.

El consumo de enzimas exógenas en la industria brasileña aumentó un 18% al final del período evaluado (Figura 3).

Figura 3. Consumo de enzimas exógenas entre 2017 y 2021.

El desempeño zootécnico está directamente relacionado con la capacidad digestiva y de absorción de los animales. Así, garantizar la salud intestinal es fundamental para reducir las pérdidas productivas y económicas.

Durante muchos años, la búsqueda del equilibrio de la microbiota intestinal se basó en el uso de antibióticos para controlar agentes patógenos.

Sin embargo, en el escenario actual del mercado, utilizar estos aditivos como promotores del crecimiento ya no tiene espacio, siendo necesario utilizar aditivos alimentarios alternativos para evitar pérdidas en la productividad de los pollos de engorde.

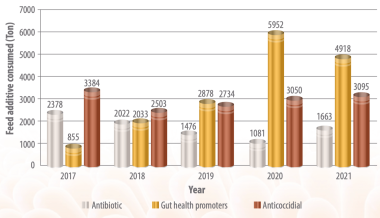

Los datos expusieron una reducción del 30% en el uso de antibióticos (Figura 4) desde 2017 hasta la actualidad. Esta caída está motivada principalmente por:

- La creciente preocupación de los consumidores por los antibióticos en la alimentación animal.

- prohibiciones de varias moléculas promotoras del crecimiento en Brasil, y

- varios otros países donde Brasil exporta.

Figura 4. Consumo de antibióticos promotores del crecimiento, promotores de la salud intestinal y anticoccidiales en Brasil de 2017 a 2021.

| Existe la posibilidad de que el uso indiscriminado de antibióticos promotores del crecimiento contribuya a la resistencia cruzada de los microorganismos a los antibióticos utilizados en la medicina humana. |

En el mismo sentido, el uso de algunas sustancias, como los ionóforos anticoccidiales, disminuyó en un 9% , aunque estos fármacos fueron reemplazados por anticoccidiales sintéticos en el mismo período evaluado.

Por otro lado, se ha ampliado la suplementación dietética con otros aditivos alimentarios que pueden ayudar a la salud intestinal de los pollos de engorde. Entre estos aditivos, las principales alternativas a los antibióticos promotores del crecimiento son:

- prebióticos,

- probióticos y

- Ácidos orgánicos y fitógenos.

El uso de estas clases de aditivos alimentarios aumentó un 475% en los últimos cinco años. El volumen total consumido se dividió en:

- 39,17% ácidos orgánicos,

- 38,68% fitógenos, y

- 22,14% pre y probióticos.

La variedad de aditivos alimentarios disponibles en el mercado se ha vuelto más destacada a lo largo de los años.

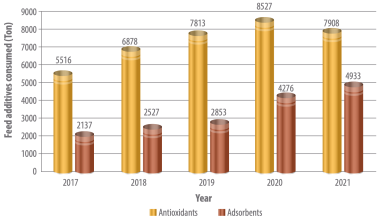

Un aumento en la adopción de otros mejoradores de la salud intestinal y enzimas va de la mano con la inclusión de antioxidantes, aditivos contra la salmonella y adsorbentes de micotoxinas (Figura 5).

Figura 5. Utilización de antioxidantes y adsorbentes de micotoxinas en Brasil en los últimos cinco años.

Todos estos productos también intentan eliminar bacterias y hongos, o sus metabolitos, de los piensos, evitando daños a la salud animal y humana. Estas nuevas tecnologías pueden ayudar a lograr altos índices zootécnicos.

Pero los nutricionistas avícolas deben comprender y evaluar el impacto real de cada tecnología adoptada y los efectos sinérgicos o antagónicos de las diferentes asociaciones de aditivos alimentarios en cada condición de producción de pollos de engorde. En estas valoraciones se debe considerar el rendimiento animal y el retorno económico de las estrategias elegidas.

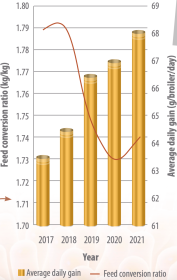

Cuando evaluamos los datos del rendimiento vivo de los pollos de engorde durante este período, observamos una mejora del 7% en el aumento de peso corporal diario promedio (Figura 6).

Figura 6. Ganancia de peso corporal promedio diaria y conversión alimenticia de pollos de engorde en Brasil de 2017 a 2021. En 2021, el peso corporal promedio fue de 3,04 kg a los 44,68 días en edad de sacrificio.

- Estos valores pasaron de 63,5 g a 68,1 g/día,

- mientras que la conversión alimenticia disminuyó aproximadamente un 3%,

- reduciendo el consumo de alimento por kilo de pollo vivo terminado hasta en 50 gramos.

- Estos resultados consideraron un promedio nacional bruto de 3,04 kg a los 44,68 días en edad de sacrificio en 2021.

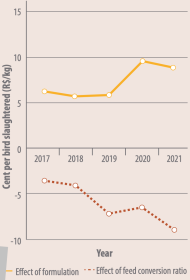

Asimismo, cuando comparamos el efecto del costo de conversión alimenticia y el efecto del costo de la formulación sobre el kilogramo de pollo vivo (Figura 7), detectamos que la conversión alimenticia de los productores brasileños de pollos de engorde ha mejorado con los años.

Figura 7. Efectos de la conversión alimenticia y el costo de la formulación del alimento sobre el costo del pollo en Brasil de 2017 a 2021.

La conversión alimenticia actual proporciona una ganancia de nueve centavos (R$) por kilogramo de pollo en comparación con el promedio mundial.

Históricamente, el costo de la nutrición de los pollos de engorde en Brasil es más alto que en otras partes del mundo debido a los altos niveles de nutrientes y los ingredientes adicionales que se utilizan.

Estos ingredientes alimentarios incluyen harinas de subproductos animales, aceite de soja, aminoácidos sintéticos y aditivos alimentarios alternativos cuyo precio ha aumentado significativamente a lo largo de los años.

Estos costos más altos de los piensos y aditivos para piensos encarecieron las formulaciones, lo que resultó en 9 centavos (R$) más por kilo de pienso en comparación con otras industrias avícolas importantes como Estados Unidos.

En el escenario actual, donde los ingredientes alimentarios como el maíz y la soja se encuentran en el punto más alto de los precios históricos, las ganancias en la conversión alimentaria a menudo no recuperan el retorno de la inversión realizada en la nutrición de los pollos de engorde.

Actualmente, la industria avícola brasileña ha mantenido estos factores en equilibrio; sin embargo, para lograr una mayor competitividad global, la conversión alimenticia debe mejorar más para minimizar el impacto de los mayores costos de los alimentos en el costo total de producción, o los nutricionistas avícolas deben formular dietas más rentables.

Considerando todos estos datos, es posible concluir que, incluso frente a todas estas adversidades, el sector brasileño de pollos de engorde logró adaptar la nutrición a las condiciones desafiantes del mercado y optimizar las necesidades reales de las nuevas líneas genéticas, permitiéndoles expresar su máximo potencial.

- De hecho, para que la producción de pollos siga creciendo en los próximos años en Brasil, los responsables de la nutrición de los pollos de engorde deben buscar innovaciones que puedan traer beneficios económicos, socioambientales y zootécnicos a la cadena productiva.

Visitar aquí

Te puede interesar: Controlar la temperatura del agua durante la crianza

[/registro]

PDF