14 Jul 2020

Poultry quarterly Q3 2020, fragile recovery after Covid-19 Storm

The global poultry industry is gradually recovering from a storm that hit in 1H 2020. Covid-19 containment restrictions on foodservice […]

The global poultry industry is gradually recovering from a storm that hit in 1H 2020. Covid-19 containment restrictions on foodservice and traditional distribution, as well as supply disruptions, have had a big impact on markets, with prices falling almost everywhere in Q2 2020. The outlook is gradually improving, as these measures are eased in most markets, while supply has dropped due to lower placements and, in some cases, parent stock reductions.

The biggest market driver in 2H 2020 will be the economic downturn, which will make global markets more volatile and price driven. Such conditions are generally positive for poultry, as the cheapest meat protein with a short and flexible production cycle. Volatility could be exacerbated on the bumpy road to recovery, as governments try to stop Covid-19 from spreading further, by ongoing challenges to balance supply and demand and by exchange rate volatility. On the other hand, the relatively bearish feed price outlook will provide producers some relief on the cost side of their businesses.

Poultry demand will be more bullish in 2H, as Covid-19 containment measurements are eased, lifting demand through foodservice. In addition, poultry will benefit from its price competitiveness during an economic downturn.

Global trade will remain volatile in 2H. Demand will recover as restrictions on out-of-home and wholesale markets are lifted, but supply-demand imbalances, FX volatility, and access issues could distort trade flows. A trend of buying local may also challenge trade flows.

Poultry prices will see some recovery after historic lows in 1H, with traded poultry prices dropping between 5% and 25%. Breast meat should benefit from the reopening of foodservice, although trade will remain difficult. Dark meat will likely do better. Supply in some markets will be tight, due to reduced parent stock.

Trade agreements and restrictions have the potential to keep shaking up global trade flows. The US-China trade relationship, Brexit, and a move in the Middle East to further improve food security are the main factors that could disrupt global poultry trade.

Outlook 2H 2020: Price-Driven, Highly Volatile Market

Continue after advertising.

The global poultry industry has been heavily hit by Covid-19’s impact in Q2 2020. Prices have dropped in many markets to (historically) low levels, due to lockdown restrictions on people’s movements and food distribution and also due to supply challenges in distribution, the value chain, and operations.

In most markets, we saw prices jump initially, as consumers were building up stocks to prepare for containment measurements set by governments.

This peak was followed by big drops in most markets, as containment measurements were implemented. These measures included restrictions on or closures of out-of-home food consumption (via foodservice) and even on (some parts of) retail food distribution. Foodservice is an important part of the global poultry value chain, representing from 15% to 60% of total poultry sales. Any restriction on foodservice operations has the potential to shake up the market. The same can also be said of restrictions on wet and fresh-meat market sales. In many emerging markets, these markets represent 50% to 95% of total poultry sales. In India, rumors spread via social media about the supposed-but-untrue Covid-19-poultry link pushed prices to historic lows in February and March.

In most countries, market conditions have followed a similar pattern, though the timing of the peak of Covid-19 cases has been different. In all markets, we tended to see a short-lived price peak (panic buying), a big price drop as containment measures were implemented, and, as new cases reduced, some easing of restrictions. The industry tended to reduce chick placements during the peak Covid-19 period, which usually led to some market recovery after two months.

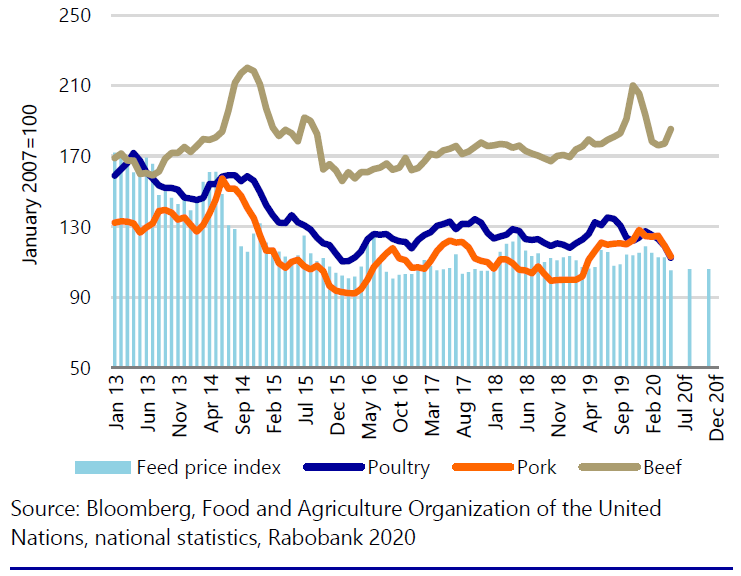

Figure 1: Global broiler, beef, and pork prices vs. feed cost monitor, 2013-2020f

As food retail has remained open throughout, suppliers into this channel have seen strong demand, while suppliers to foodservice and traditional markets have seen falling demand. In developing countries, such as Peru, Pakistan, Bangladesh, Iran, and several African countries, prices have dropped to historic lows. Distribution in these markets usually depends on traditional channels and foodservice, which have been highly disrupted.

Poultry prices have not been the exception. Other proteins, such as pork and beef, have also seen dropping prices. Pork-producing countries with access to the Chinese market benefit from ongoing low pork supply resulting from African swine fever (ASF) outbreaks since August 2018. Pork production (in metric tons) dropped by more than 20% in 2019 and is expected to drop in 2020 by more than 15%. China’s strong demand for pork imports will keep supporting prices in the EU, the US, and Brazil. Other ASF-affected countries in Asia, like the Philippines and Vietnam, will also see similar price support, due to low local pork supply.

In our base-case scenario, we expect governments to gradually ease restrictions on people’s movements. Governments will retain the potential to re-implement these restrictions if Covid-19 cases jump again, as seen in Korea, China, the US and the UK.

Global economic conditions for the remainder of 2020 will be very challenging, with Rabobank forecasting a -3.9% GDP decline. As we will see a global economic downturn, market conditions will likely become more price driven in 2H 2020. This should support poultry demand, as chicken is the lowest-priced meat protein.

We should also expect Covid-19 cases to return from time to time in different countries, as already seen in some countries, like China and Korea. This will likely mean governments ramping up and scaling back strategies to reduce spread of the virus. This could also result in ongoing changes in containment measures leading to increased volatility in poultry markets.

Global Trade Will Stay Highly Volatile

Poultry trade has been highly affected by the Covid-19 crisis, with government containment measures impacting trade in poultry meat and breeding stock. The biggest drivers of volatility in trade have been:

- Global lockdowns. They have led to the collapse of demand in foodservice, with knock-on effects for the international markets, which are typically the categories where traded poultry is sold.

- Supply disruption. Oversupply and high stocks have led to big differences in availability and prices.

- Distribution. Border closures have affected trade. Flight cancellations and the availability and pricing of containers have highly challenged trade.

- FX volatility. This has led to changing competitive positions of countries. Brazil, Russia, and Argentina have improved their pricing position in global markets.

- Avian influenza (AI) outbreaks. This has especially affected trade from eastern European countries, like Poland and Ukraine.

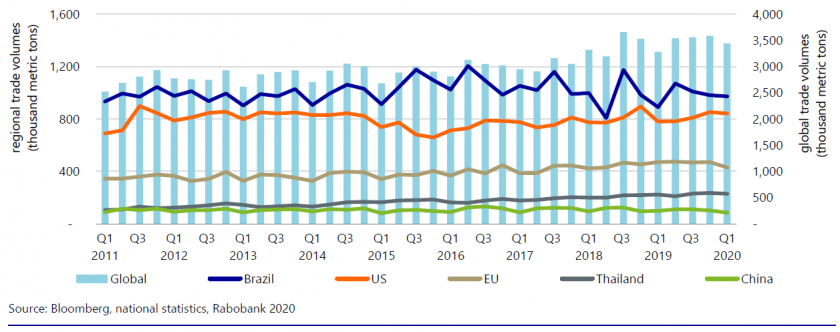

These volatility drivers have led to big changes in the market positions of exporting countries (see Figure 2). In terms of volume, the winners in Q1 were: Brazil (+9%), the US (+8%), Russia (+66%), and Argentina (+23%), while exports from the EU (-9%) and China (-14%) dropped sharply due to AI’s impact (EU) and Covid-19 disruption (China). This trend has continued in April and May, when volatility in FX increased. Brazil has also reported ongoing export growth, based on initial figures for the first five months, while Russia has seen good demand from China in April/May.

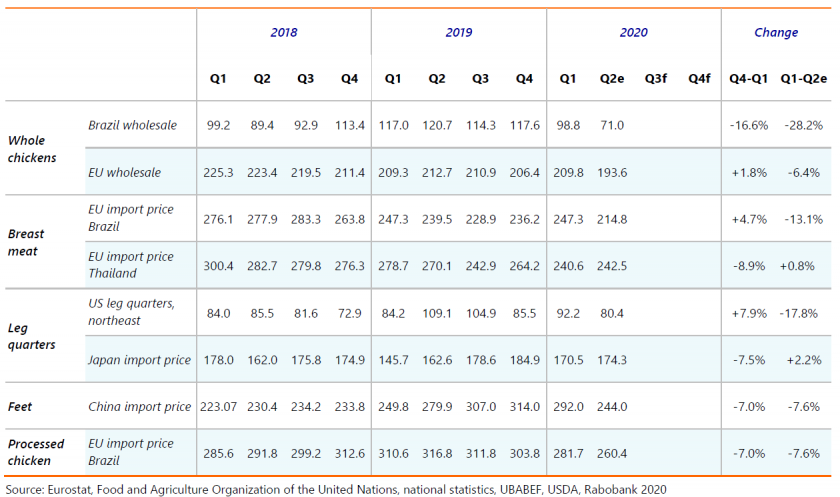

The very volatile trade conditions have also had a big impact on prices for global poultry cuts (see Figure 1 and Tables 1 and 2). Depreciation of the BRL, together with local oversupply and very competitive global conditions, has made poultry in Brazil relatively cheap on international markets. Prices for live chickens and whole chickens dropped in Brazil by 23% and 28%, respectively, in April/May, compared to last year. These low prices have been a driver in international trade. In addition, local oversupply in import markets, such as the EU, Japan, the Middle East, and Africa, also affected trade. Cuts like breast meat (-13%), legs (-18%), feet (-8%), and processed meat (-8%) have seen big drops in price, reflecting global oversupply with rising cold storage levels.

The outlook for global trade is for ongoing volatility. On the positive side, we see demand starting to recover, as most countries are moving out of lockdown, with foodservice demand picking up as a result. Given the uncertainties around the Covid-19 situation, we see ongoing shifts up and down in demand, which will add to the volatility. The impact on prices will also show some delay, as stocks in many markets are still high, which will influence the buying behavior of traders.

The reduction in production in exporting countries, such as Brazil, the US, the EU, and Thailand, will support a gradual recovery in 2H. It will, however, be important for producers to remain disciplined in 2H, as the expected volatility can quickly create new oversupply situations.

China will remain a main market for global poultry, due to the shortage of protein supply driven by ASF. Imports have increased by 89% in the first four months of 2020, with significantly more supply from the US and Russia, while Brazil’s market share tended to decline. Demand from China is expected to stay strong in 2H.

Some import markets, especially in the Middle East, Africa, and Asia, might see some shortages, if demand improves and supply stays short. This could lead to opportunities for traders.

Some relatively open countries, like the Philippines, Mexico, Vietnam, and African markets, like Ghana, Congo, and Angola, have seen big volumes of low-priced poultry moving into their markets.

Figure 2: Rabobank global poultry trade monitor, Q1 2011-Q2 2020

Covid-19: All Key Markets Affected

From a regional profitability perspective, we have seen a drop in market conditions for poultry globally, with very few countries protected from the impacts of Covid-19. Australia and New Zealand are probably the only exceptions; these markets are relatively independent of global trade flows, so they have been less susceptible to the Covid-19 market conditions.

All other major markets – China, the EU, the US, Brazil, India, Russia, South Africa, and Thailand – have seen prices drop fast after Covid-19 cases were detected locally, with foodservice and traditional distribution and sales under pressure.

Local industries have been trying to rebalance supply and demand by reducing placements, which, in most cases, leads to market recovery in around two months. This timing has coincided with governments lifting containment measures, further assisting the market to rebalance. In the US, for example, QSR sales are almost back to pre-Covid-19 levels, while demand in other foodservice channels, such as catering and restaurants, is still down. We expect the recovery to move in gradual steps, with differences in the speed of the recovery between the various distribution formats.

For 2H 2020, we expect markets to be price driven and volatile in most countries. Export-oriented businesses and traders will benefit as markets recover, but their business will likely be slower than companies that are more domestically focused, with food retail-focused companies enjoying the best market conditions.

We also expect some poultry shortages in some countries. During the tough 1H market conditions, some countries reduced parent stock, with weak local demand and complex logistics to distribute hatching eggs and DOCs contributing to reduced supply.

Feed Price Outlook Becoming More Bearish

The outlook for grain and oilseed prices has changed since the beginning of the year, from a slightly bullish outlook, to stable, and now to a slightly declining price outlook, with levels now up to 20% below early 2020 expectations. In some countries, like Brazil and India, the outlook is even more bearish. Slower demand has been an important factor, with Covid-19 reducing feed demand expectations, low oil prices and low biofuel demand are also contributing, along with improved harvest expectations in eastern Europe, India, and Latin America.

The main downside is the ongoing high price for some feed additives, like vitamin D and threonine, of which supply has been disrupted by the Covid-19 crisis.

Trade Disruptions Will Also Affect 2H 2020

Trade disruptions will be important change factors in 2H 2020. Several bilateral trade negotiations will open some new trade flows, while local trade policies will restrict trade in other markets.

Table 1: Global live broiler and feed ingredients monitor, Q1 2018-Q2 2020e

The most obvious trade agreement has been the ‘phase- one’ trade deal between the US and China. Re-entering China’s fast-growing USD 2bn import market has long been a goal for the US industry. Exports from the US have been strong but still a little under expectations, with further growth expected in the coming years. The long absence of US poultry exports in China means US exporters need to regain their understanding of specific market needs and access to local distribution.

Russia has been active and successful in opening markets for poultry exports. Since opening in 2019, China has become the number one export market for Russia and now represents 50% of Russia’s fast-growing trade. In the coming year, exports from Russia to China will rise further, especially as Russia is trying to open an inland rail route to central China to significantly reduce travel time compared to sailing routes.

As its current dependence on China is rising, it is important for Russia to also diversify its export destinations. Russia continues to open new markets. In Q1, Russia gained access to UAE and Japan (for some parts of Russia). Now the Philippines, Singapore, and Cuba have been opened. This increased market access has made Russia a major exporter in global poultry in a short period.

Saudi Arabia has been gradually implementing tougher requirements on imports. The introduction of strict halal guidelines has been important, along with the stricter implementation of sanitary and veterinary requirements. This policy has been successful from a food security perspective during the Covid-19 pandemic, and it is expected to continue further in this direction, similar to other gulf states like the UAE, Bahrain, and Qatar.

Brexit. The UK is expected to leave the EU market at the end of 2020, and this could shake up intra-EU trade. Along with Germany, the UK is the biggest intra-EU import market. Any new trade agreement with these exporters could impact the competitive situation in the EU. The UK government is exploring all opportunities, including opening up trade with the US. The extent to which the UK is willing to move away from EU food safety standards has become a part of the political debate over future trade access. Even if UK food safety standards change, it is not clear if, or how fast, UK food retailers and foodservice companies will vary their own sourcing strategies and standards.

Table 2: Global whole-chicken and chicken-cut markets (USD/100kg), Q1 2018-Q4 2020f

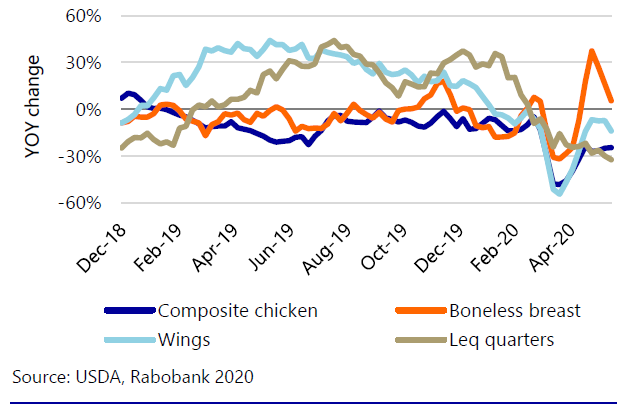

US

US broiler markets were exceptionally volatile during the past quarter, facing some of the most dramatic pricing and production shifts in recent memory. The disruption associated with the loss of foodservice and the subsequent hoarding of product at retail drove a 33% sequential drop in composite broiler prices in April, followed by a 29% improvement in May (see Figure 3). Despite a slow recovery in casual dining and white tablecloth restaurants, a rapid rebound in quick service sales helped stabilize breast meat and tender markets in early May. Tight supplies of competing proteins also helped support the rebound in price, but with the outlook for foodservice weak and many sporting events cancelled, we remain relatively cautious on the near-term pricing outlook.

The US industry cut back broiler production in late March and April, with placements down 14m in May, or 7.2% versus year-ago averages. However, there was no noticeable change in the breeding flock through April. With expected returns poor due to the weaker price outlook, we expect some contraction in May and June. Broilers slaughtered should also decline in coming weeks, as the impact of lower chick placements takes effect. This will be partially offset by a gradual increase in weights however. For the year, we continue to expect 1% production growth, as consumption should benefit as consumers trade down to lower-cost proteins. Exports began the year very strong, with sharply higher volumes to Mexico through March and a rebound in sales to Cuba in April. We expect improved export interest as dark meat and paw prices remain under pressure on expected supply.

Figure 3: US poultry prices, Jan 2019-May 2020

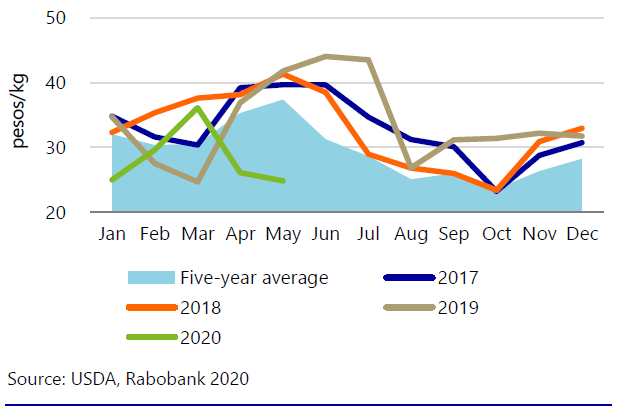

MEXICO

Like many other markets, Mexico has seen significant disruption in its domestic poultry industry due to the coronavirus. Producers quickly adjusted production to reflect the weaker demand in foodservice, yet cuts are only now being reflected in weekly numbers. Production through May had averaged 4% above year-ago levels, responding to strong underlying growth in productivity and consumption to start the year (see Figure 4). Good flock health year to date helped support the improvement. Since collapsing in April following government-issued stay-at-home orders and bottoming at MXN 20/kg in early May, chicken carcass prices are now approaching MXN 35/kg in June. Breast meat saw the sharpest drop (down 24%) in price, whereas leg quarters lost only 15%. Until high-cost inventory is worked lower and demand improves, we believe production will remain depressed. We continue to look for production growth to slow over the balance of the year, particularly if economic growth falls short of expectations.

Exports through March were strong, as good demand from Cuba helped buoy total volumes shipped by 35%, to 579,000 metric tons. Imports of chicken continue to be dominated by the US (95% of total) and were up 10% through Q1 2020, to 245m metric tons or roughly 22% of total availability. Lower US dark meat prices, due to oversupply, should continue to drive steady export volumes into Mexico, albeit at lower overall values. Mexican imports of Brazilian chicken are down substantially after its tariff rate import quota (Coupos) was not extended earlier this year. Reduced Brazilian imports should also be supportive to breast meat prices.

Figure 4: Mexican poultry imports from the US, 2018-2020

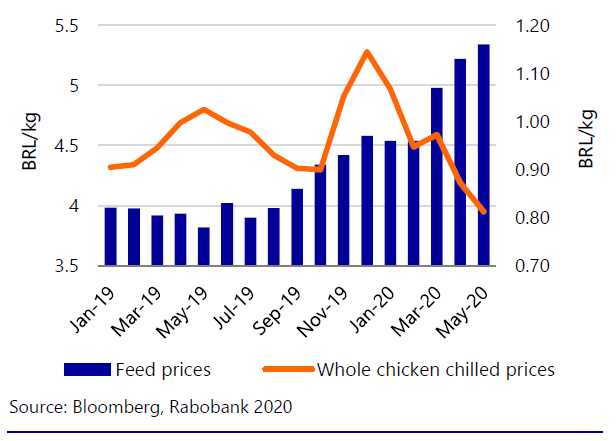

BRAZIL

After wholesale chicken prices reached historic levels at the end of 2019, the year started with an increase in production due to increased margins. However, the significant drop in domestic consumption, especially in foodservice, coupled with increasing appreciation of feed costs, led to reduced production in the following months.

Foodservice saw a slight recovery of 1.5% in the last two weeks (as isolation measures eased in some regions), but is still down markedly in accumulated consumption (-61% YTD), while food retail has recently seen a 16% increase (period from March 1 to June 6).

After a sharp drop in retail prices of 13% in April (frozen chicken), due to increased production coupled with a drop in domestic consumption, prices rose again at the end of May and on June 9 were 2% higher than the previous month (see Figure 5). This is the result of greater balance between supply and demand. Live chicken prices, which also registered a strong monthly drop of 10% in April, recovered 3% in May. The partial average for that month is 15% higher than the previous month.

Production in Q1 2020 was up 3% YOY, according to partial data, but the sector reduced pace in the following months, due to the drop in domestic consumption. The seasonal improvement in demand in 2H is expected to boost production in the middle of Q3.

Corn future prices indicate falls in the short term with the harvest of the second crop approaching, which represents 70% to 75% of production. This increased supply will put pressure on feed prices, which are, on average, 31% more expensive in May YTD.

Figure 5: Brazilian chicken and feed prices, Jan 2019-May 2020

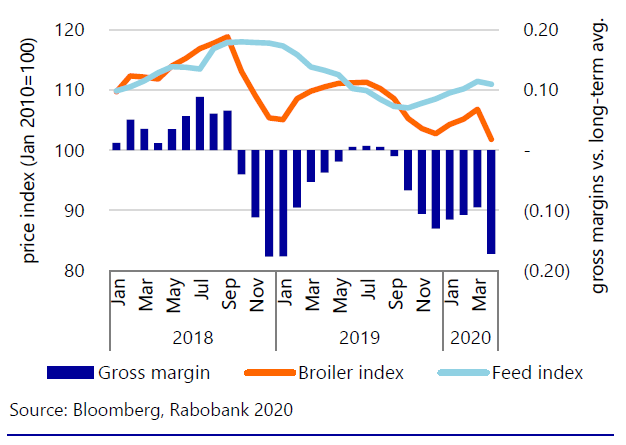

EUROPE

The European poultry industry has gone through a turbulent Q2 under the effects of Covid-19. The lockdowns initially led to poultry demand and prices peaking on consumer panic buying, but this was short lived. Prices have dropped by 15% on average since March, with larger drops in countries focused on exports, such as Poland and the Netherlands (see Figure 6), and non-EU imports (-15%). On the other hand, retail-driven businesses have performed better. Retail demand, for example in Germany, peaked in April, with a 24% increase YOY, while foodservice demand was down by 70% to 90%.

The weak Covid-19-related intra-EU trade conditions have been worsened by a period of oversupply in the market. This is especially the case in eastern Europe, where AI cases have restricted exports. Export restrictions on Poland, as well as very competitive global market conditions, led to the biggest drop in total EU exports in a long time (-15%) for January to April. The weak market conditions have been exacerbated by some first signs of Brexit impacts, with demand for poultry imports into the UK dropping by 26% from January to April.

The outlook for the European industry is improving, especially as placements dropped significantly since the second half of April. The biggest drops have been in Poland, the Netherlands, Hungary, and Spain. The impact is now being seen with some improvement in prices. This is likely the start of a fragile recovery, especially as lockdown restrictions are gradually being eased, which will help demand recover. In 2H 2020, we expect conditions to be very price driven, as the economic downturn will dominate the market and potential new Covid-19 cases could create further volatility.

Figure 6: Broiler feed price and margin trend in northwestern Europe, Jan 2018-Jan 2020

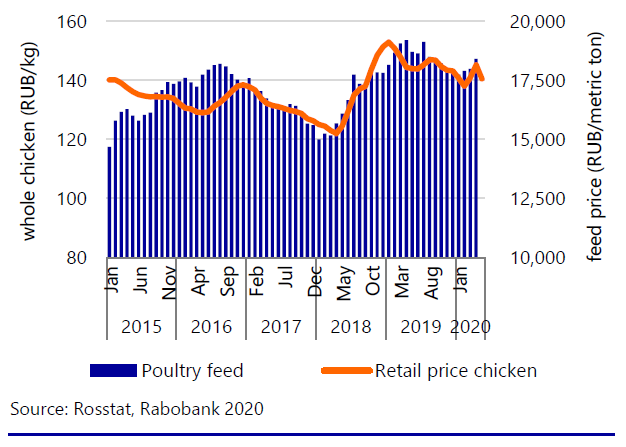

RUSSIA

The Russian poultry market has gone through challenging market conditions in Q2. Volatility increased significantly, given the lockdown measures set by Russian federal and regional authorities at the end of March. Although prices for poultry products initially peaked due to panic buying, prices have dropped by 10% since the second half of April, compared to March levels. Pork prices also dropped significantly in this period but recovered in the second half of May. Russian feed prices increased in April, despite some restrictions on wheat and soybean exports, with RUB depreciation being one of the main reasons (see Figure 7). RUB depreciation has supported Russian poultry exports, making Russian products more competitive in International markets. Exports of poultry increased by 67% in the first four months of the year, with China being the biggest export destination (with around 50% of total exports).

Retail prices have been relatively stable, highlighting the challenge some processors have had in managing volatility in their value chains (see Figure 7).

The outlook for Russia will be challenging. A sharp recession has been forecast for Russia by the IMF, with GDP down by 5%. This will impact market conditions, with more price-driven buying expected, which could support poultry demand. Conditions will stay volatile until Covid-19 is less of an issue. A relatively good grain harvest predicted for this crop year is a positive, with expectations for a slight increase on last year to 122.5m metric tons. Trade will be strong, with exports of 250,000 to 280,000 metric tons possible, compared to 210,000 tons last year. Singapore, the Philippines, and Cuba have recently been opened for Russian poultry.

Figure 7: Russian retail frozen broiler (LHS) and feed price (RHS) trends, Jan 2015-May 2020

SOUTH AFRICA

South Africa has been in a hard lockdown, with restrictions on people’s movements and only essential services open for business. This has significantly impacted local markets and the economy (GDP growth outlook for 2020 is -5.8% YOY, according to the IMF). Lockdown measures started being eased in May.

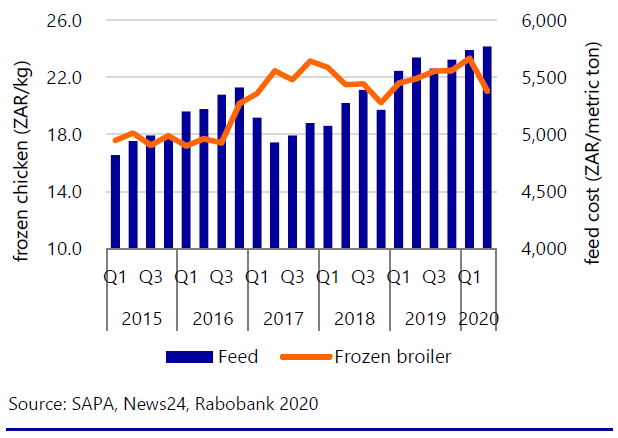

Poultry (and other meats) have been affected by this lockdown, with prices falling for poultry (-10%), pork (-22%), and beef (-5%) compared to Q1 levels, while feed prices went up by 1% (see Figure 8). The lockdown came in a period of high supply, with production up 4% and imports up 1% compared to Q1 2019. The almost complete disappearance of foodservice demand led to big stocks, oversupply, and falling breast meat prices. Poultry prices went down to below import parity level, causing imports to drop in April by 24%.

The poultry outlook is challenging and more bearish than it was in our Q1 outlook, when the strong grain harvest was indicating falling feed costs in 2H. This is now offset by a big depreciation of the ZAR, which has pushed up domestic grain prices. Current SAFEX future prices indicate stable to slightly increasing grain and oilseed prices for 2H.

On the positive side, the easing of lockdown measures should now support demand recovery, while imports will be pressured by ongoing weakness of the ZAR. Under these conditions, the industry will be price driven, as the impact of recession and rising unemployment influence consumer sentiment. The current trend of trading down is expected to stay, with strong demand for relatively cheap cuts like livers, necks, heads, and feet and with gradually improving breast meat prices.

Figure 8: South African broiler and feed price trend, Q1 2015-Q2 2020f

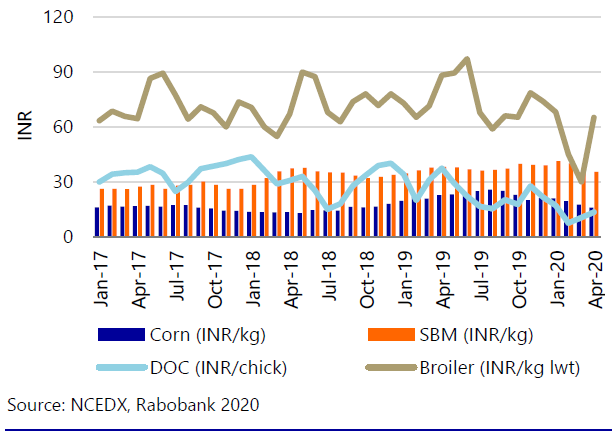

INDIA

Demand for broilers nosedived during March and April by more than 50%, due to supply chain disruptions and closure of foodservice channels. Broiler prices remained low during that time, pushing integrators/commercial farms to reduce DOC placements. Reduced feed demand, combined with the incoming rabi season harvest, led to a decline in feed prices, with maize ranging between INR 13 to INR 16/kg (20% to 25% lower YOY). Soybean meal also stayed lower compared to last year (see Figure 9).

After more than two months of lockdown, the government removed restrictions (except in a few states) in early June. Consumer retail demand is expected to strengthen with a gradual improvement in supply chains and logistics. However, labor shortages will continue to create challenges in the next quarter, and business-to-business demand (restaurants, HORECA) is expected to remain soft.

Broiler prices have jumped to higher levels, ranging between INR 100 to INR 125/kg, due to improving demand and low supplies. The industry is expecting a correction in prices in July/August, ranging between INR 90 to INR 110/kg. This is also pushing an increase in DOC placements, although companies are wary of sudden supply increases. This can create supply-demand imbalance and impact prices and margins in a negative way.

With ample stocks, feed prices are expected to be bearish, and the forecast for good monsoon rains is expected to boost kharif crop sowing/production. Maize prices are expected to be between INR 14 to INR 18/kg for the next quarter. Soybean meal prices are expected to be between INR 33 to INR 37/kg.

Figure 9: Indian broiler, DOC, and feed price index, Jan 2013-Apr 2020

CHINA

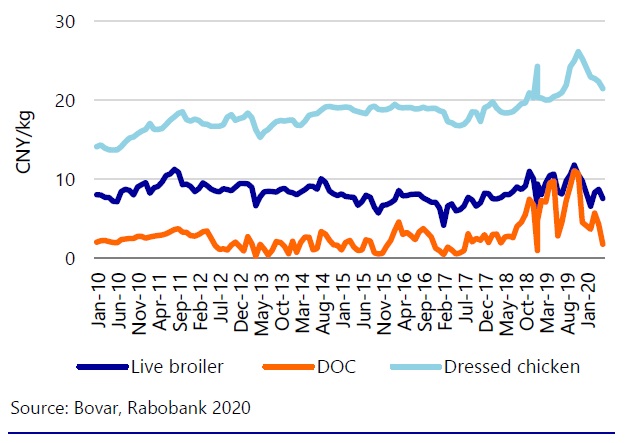

China’s industry was expecting to step out of the negative impacts of Covid-19 entering June, but a new challenge has emerged. The virus has been found in several fresh produce wholesale markets in Beijing since the second week of June, after zero cases for more than 50 days. This has led to all schools in Beijing being closed. In addition, there have been related cases in other provinces. Whether this evolves into a national situation is difficult to predict, so demand will likely fluctuate if strict quarantine measures are taken in more regions. The positive side is that during two sessions, the government issued a series of policies to encourage small businesses to reduce unemployment. Among them, street vendor businesses, which have been banned in many cities in recent years for the sake of city management and food safety, are expected to help increase demand for low-cost proteins like chicken.

April and May saw great volatility, with prices of DOC dropping to CNY 1.8/bird and prices of live broilers dropping to below CNY 7/kg (see Figure 10). The weak performances reflect weak demand, as foodservice and institutional purchases were not back to normal. Farmers made losses in May, due to weak prices. In the first week of June, poultry prices rebounded, following the strong increase in pork prices.

Poultry imports in the first four months have increased strongly, up by 89% YOY, to reach 410,830 metric tons. Meanwhile, the market shares of top suppliers have changed substantially, with Brazil’s share falling from over 80% in 2018 to 58% in the first four months of 2020, Russia rising from zero to over 10%, followed by Thailand and the US. In April, the US jumped to become the second largest exporter to China, following the signing of the ‘phase-one’ deal.

Figure 10: Chinese poultry prices, Jan 2010-May 2020

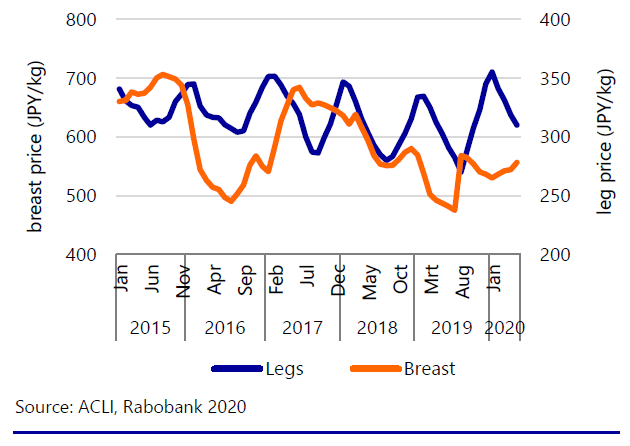

JAPAN

Japan was one of the first countries affected by Covid-19, with the number of cases peaking in April and then gradually reducing. The country followed an approach different from some other Asian countries, with more focus on social distancing without full closures of businesses. This has resulted in a lower impact on domestic market conditions than in other countries, although Japan has seen some pressure on prices, especially for more expensive products like Wagyu beef, but also for the chicken thighs market, which dropped 10% to 15% below last year’s levels. Reduced demand has pushed up stock levels for all types of meat, including poultry. This has pressured Japanese imports, with imports down in April by 1% after rising in February (+6%) and March (+18%), compared to last year. Increasing Q1 imports were essentially driven by very competitively priced Brazilian products, due to local oversupply and depreciation of the BRL currency.

The outlook for the Japanese industry remains challenging in 2H, given the economic recession (Rabobank predicts -4.8% for 2020), which will make the market more price driven. For the poultry industry, the already lower feed prices (down 3% to 4% on the previous year) are a positive, and this is expected to decline further, due to the bearish global grain and oilseed market conditions.

The high cold storage levels in Japan will challenge the position of major exporters, such as Thailand and Brazil, as market conditions will also be very price driven in 2H 2020 in these countries.

Figure 11: Japanese poultry prices, Jan 2015-May 2020

THAILAND

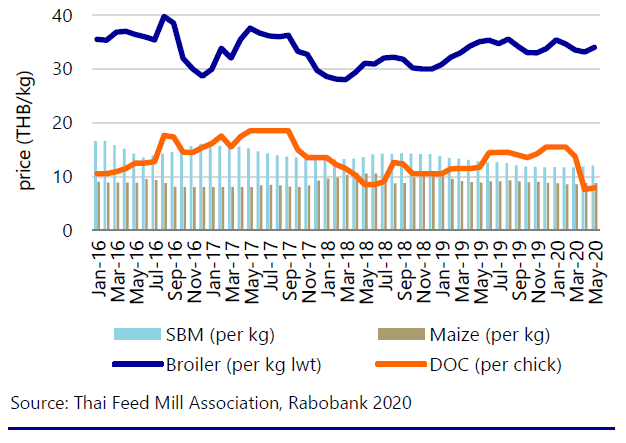

A drop in domestic consumption during Covid-19 quarantine measures had briefly depressed broiler prices to THB 24/kg lwt in April (see Figure 12). However, by May, prices had recovered back to THB 33 to THB 34/kg lwt. DOC prices stayed at THB 7.9/chick – as chick placements remained slow to pick up – and did not recover to THB 12.50 until early June. Despite this recovery, we expect domestic consumption levels for the year to remain below that in 2019, due to the extended impact of Covid-19 on Thailand’s tourism and hospitality sectors.

Q1 2020 poultry export volumes reached 236,700 metric tons, rising 2% YOY – the slowest growth rate in the past five quarters. Demand from the EU registered a 4% YOY decline, to 57,500 metric tons, while that from greater China (including HK) increased 34% YOY, to 29,800 metric tons. The highest volume went to Japan, at 116,100 metric tons (+9% YOY). April export numbers to China continued to increase; Thailand now has 22 poultry plants approved for exports to China. However, we believe exports to the EU and Japan decelerated in Q2 2020, particularly on reduced foodservice demand during Covid-19 quarantine measures in April and May, as well as the strong THB. Our export expectations for the year are now reduced to 916,000 metric tons (-4% YOY).

Rabobank expects poultry integrators’ profit growth to sequentially decelerate in Q2 2020, as export demand and stable feed mill margins will be partly offset by reduced domestic volumes.

Figure 12: Thai broiler-to-feed price monitor, Jan 2015-May 2020

INDONESIA

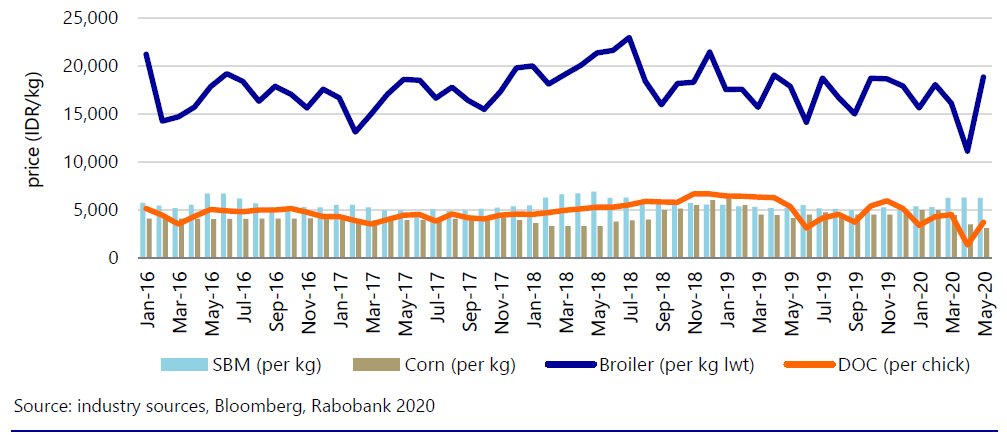

Broiler prices have increased significantly from their April low. In early June, live-bird prices in the key market of West Java were quoted at IDR 23,000 to IDR 25,000/kg lwt, up from an average of IDR 11,100/kg lwt in April. Demand has rebounded in the two weeks leading up to Lebaran, and the easing of Covid-19 quarantine measures since early June has maintained this momentum. We expect consumption to continue recovering in the near term, as retail and foodservice establishments reopen.

Supply has not kept up with the demand recovery. Many independent farmers who had suffered heavy losses have temporarily stopped chick-ins. For others, after a week-long Lebaran holiday, placements have picked up. DOC prices increased to IDR 3,000 to IDR 5,000/chick in early June – from IDR 1,360/chick in April (see Figure 13). Breeders that had reduced egg settings between mid-April and early May have since raised DOC output. We expect increased broiler supply to enter the markets by early July.

Poultry integrators’ Q2 2020 profitability may remain flat compared to Q1 2020, as lower raw material costs and higher processed chicken volumes are offset by lower feed volumes and commercial farm losses. To avoid higher broiler cost, the processing segment should be able to partly utilize its frozen inventory. Dressed broiler retail prices averaged IDR 38,283/kg cwt in early June 2020 (+9% YOY), up 31% from an average of IDR 29,214/kg cwt in April 2020. We expect prices to moderate in Q3 2020, as broiler production ramps up. We also expect margins to normalize in Q3 2020.

Figure 13: Indonesian broiler, DOC, and feed ingredient prices, Jan 2013-Jan 2020