Status of Poultry Industry in India

- India has a population of 1.40 billion people, and the number is growing every year.

- The focus is on “Development” meaning Good Food, Better Health & Living conditions to everyone.

- Presently Indian people spend more money on food when they earn more.

- Now Eggs and/or chicken are accepted by most of the communities.

The average per capita consumption of meat is around 7.4 kg and eggs 103 per person per annum in India. The growing consumer demand for egg and chicken during last two decades, has taken India to second position in egg production and sixth position in broiler production in the global poultry production charts.

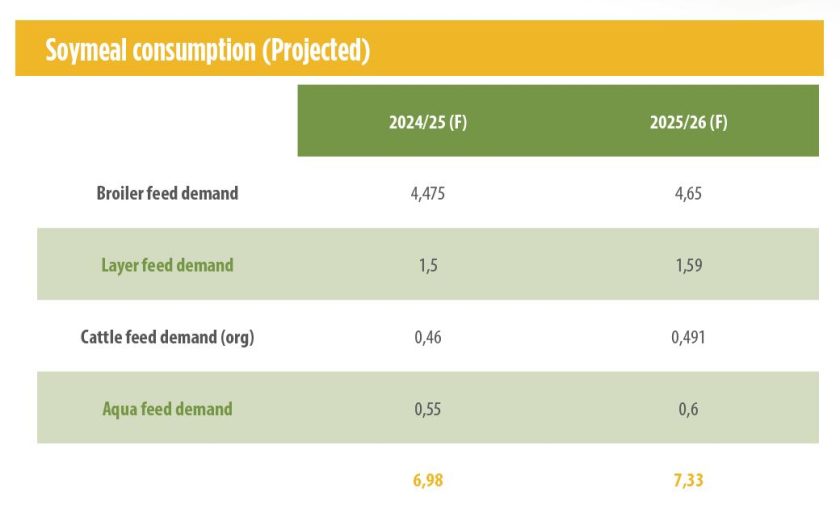

At present the layer population is around 300 million, broiler population is at 5 billion annual placement, breeder placement at 45 million and backyard poultry at 30 million (requiring approx. 32 MMT of poultry feed).

The challenge though would be moving forward

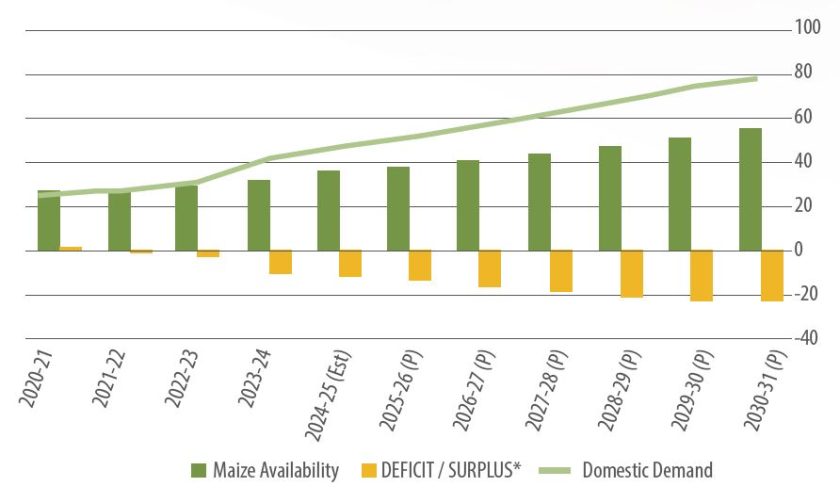

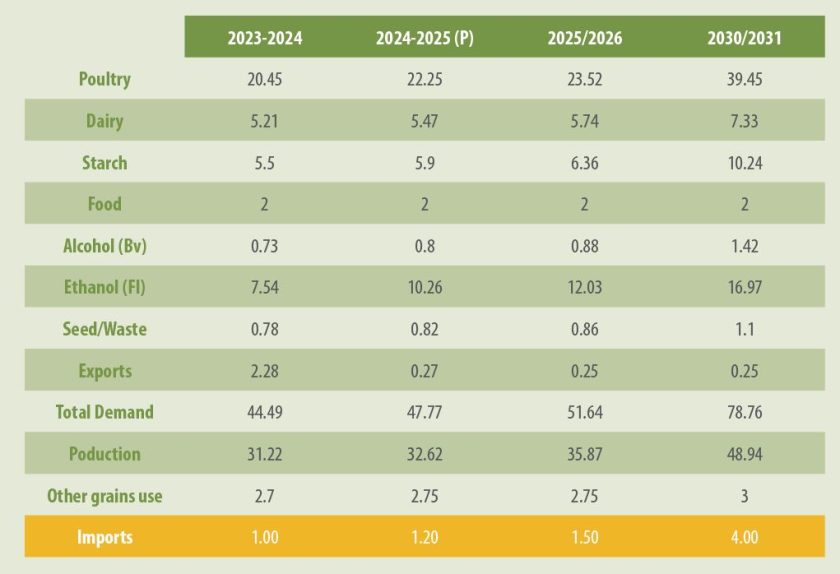

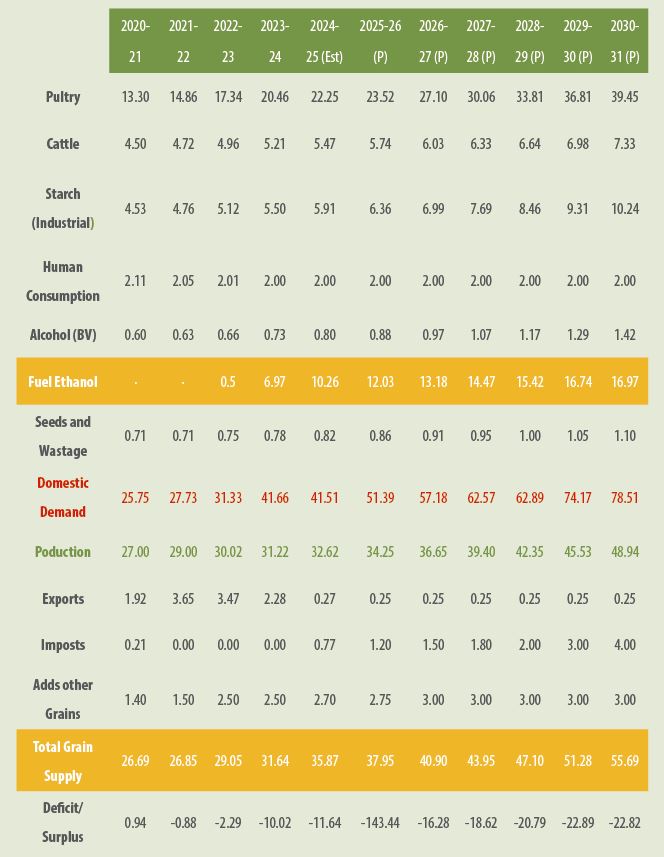

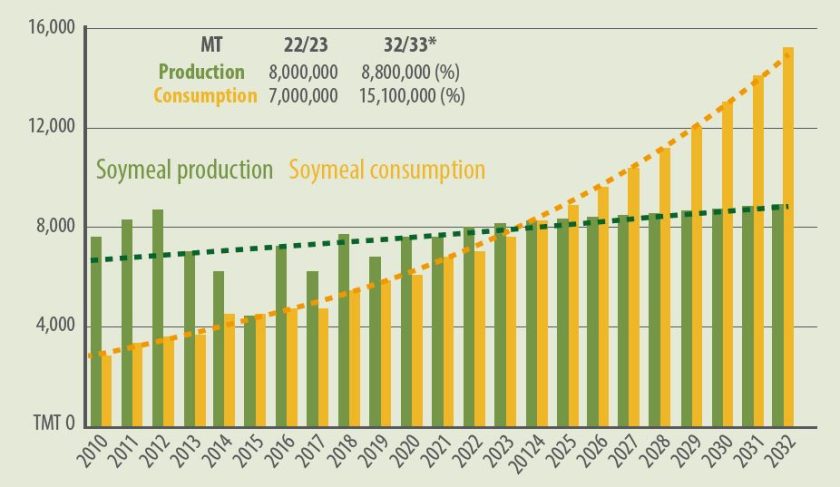

Expected layer population in 2025- 26 will be 327 million and 5.5 billion broilers, which would require 23.52 MMT of maize and 7.3 MMT of Soybean Meal. With other uses of the feed ingredients, these may not be available at a reasonable price in coming years.

- GOI had earlier allowed import of 1.2 MMT of Soybean meal in 2021-22 and there might be a need to import other feed ingredients (Maize) in near future.

Agriculture plays a vital role in India’s economy

54.6% of the population is engaged in agriculture and allied activities, contributing 17.4% to the country’s Gross Value Added.

The Agriculture Sector occupies centre stage in the Indian economy, embodying three thrust areas:

- To promote inclusive growth.

- To enhance rural income.

- To sustain food security.

Agricultural growth rate has fallen sharply to 1.4 per cent in 2023-24, compared to 4.7 per cent growth rate of 2022-23.

- India’s Total GDP is 3.2 trillion, and agriculture’s GDP is 50 lac crore.

- Total animal husbandry is worth about 15 Lac crore annually (10 Lac crore dairy, 2 Lac crore poultry, 1 Lac crore aqua, and 2 Lac crore all other animal species), which means its contribution is almost 30%.

As mentioned above, agriculture’s growth is only 1.4%, whereas the livestock industry’s growth is around 7%. We are facing an acute shortage of maize due to its demand from Ethanol Industry.

The Issue

Maize is the third most important crop after rice and wheat and is principally grown in two seasons, rainy (kharif) and winter (rabi).

- In the two-season scenario, area under maize is estimated at 19% and Rabi area at 81%.

- In 2023/24 Kharif maize is estimated at around 66% of total maize production in India, while rabi maize is estimated at 24%.

In the last few years Spring/Zaid maize has gained importance, but there are only estimates of production and it may contribute 9% of the total production.

The area and production data of maize are all at best, guesstimates and there is discrepancy in GOI and trade data.

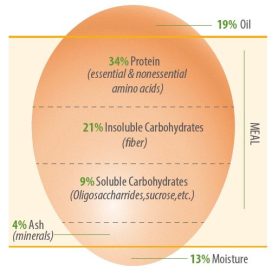

Relevance of Soy in feed/food industry

- Availability

- Affordability

- Consistent quality

- Sustainable source

- High protein

- High digestibility (88-92%)

- Better Amino-acid profile

- Source of lipids

The growth rate is 7.5 percent in layers and 9 percent in broilers per year against the growth of agriculture at 1.4 percent. Recently the Government had announced Special Livestock sector package- Animal Infrastructure Development Fund.

The poultry meat as well as egg sectors must take advantage of this financial assistance to boost infrastructure. Now Marketing of Branded Eggs is picking up in India so we should think on these lines also.

Role of various Associations

Several Poultry Associations like;

- Poultry Federation of India (PFI),

- The Compound Livestock Feed Manufacturers Association (CLFMA),

- National Egg Coordination Committee (NECC),

- Indian National Federation of Animal Health (INFAH),

- Broiler Coordination Committee (BCC),

- Indian Poultry Equipment Manufacturers Association (IPEMA),

- And similar several other National and Regional Associations

These are playing an active role by providing guidelines to poultry farmers and consumers by organizing technical seminars, placing advertisements in print and electronic media for creating awareness on health benefits of consuming poultry products.

Food Processing in India

On future of Food Processing in India, the entire Indian agriculture value chain is set to change drastically, and food processing is going to be one of the main industries of the country in next 3-5 years.

- In terms of market size, the Indian food market is expected to cross $700 billion in 2025.

- The sector has been growing consistently at the about 10 percent annually.

- Indian Food laws are being amended to international standards, and we will need to adhere to these laws in future as food safety becomes more important.

In coming years, Indian consumers are expected to shift from ‘wet market’ to dressed chicken market, because of better hygiene, reliable supplies and reasonable price. Opportunities exist in setting up the processing plants, cold chain facilities, sale counters to reach the final consumers.

E-commerce

The online segment is expected to continue to drive broiler and eggs consumption in the coming years.

Final Considerations

Poultry sector is the most organized of all agricultural sectors in India and increasing demand for eggs and chicken is evolving into a very vibrant and modern industry.

- Now the time has come for the sector to adopt newer technologies to produce safe food products and reach the consumers in real time.

To sustain this growth in the poultry sector, we will be requiring imports of GM corn and GM soybean meal to reduce the feed costs. As GM Soybean / GM Soybean Meal and GM Corn import is allowed in neighbouring countries – Nepal, Sri Lanka, Bangladesh and Pakistan, Indian poultry industry is hopeful that in coming years, Indian Government will also seriously look at allowing imports for usage in feed manufacturing.

As an industry representative we are in discussions with senior officials at animal husbandry and agriculture department.

PDF