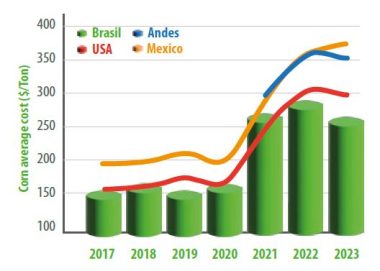

The market scenarios for poultry and pork producer companies in the feed prices market have been challenging in recent years.

Significant price volatility occurred in central grain-producing countries such as Brazil and the United States.

This adverse condition impacted those countries that import most of their main feed ingredients, such as Mexico and the Andes region, including Ecuador, Chile, Peru, and Colombia.

Some ingredient price data collected by Agri Stats in the Americas from 2017 through 2023 will be discussed.

CORN AND SOYBEAN MEAL MARKET

In 2017, a ton of corn costed US$150, but by July 2023, this cereal reached a value of US$250 per ton (Graphic 1).

Source: Agri Stats

The increment of $100 over six years increased the cost of live chicken by 11 cents per kilogram for Brazilian companies. The effect was worse in those Latin-American countries depending on importation, where 17% additional cost was observed.

A similar pattern was observed with soybean meal (Graphic 2).

Source: Agri Stats

In six years, the cost of this protein source increased by US$ 200 per ton. In 2017, the value was US$ 311; by July 2023, it reached a historic value of US$ 511. For the importer countries in the region, soybean meal arrived at their feed mills for $600 per ton.

During the years of record prices for soybean meal, soybean oil also recorded its highest value in 2022 in this six-year series. Producers’ response was to reduce this ingredient’s consumption and use more full-fat soybeans in feed formulation.

FEED COSTS

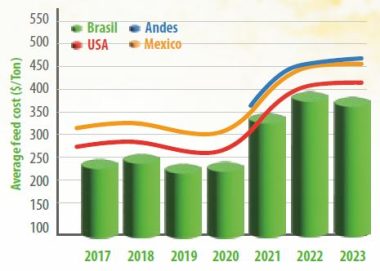

In 2017, broiler feed costs were around US$ 250 per ton; by July 2023, it had reached US$ 400 in Brazil and the United States (Graphic 3). For countries that import raw materials, feed in 2017 went from US$ 300 to $500 per ton, not counting the costs of manufacturing and delivering feed, which added up to 20 dollars per ton.

Source: Agri Stats

Several factors contributed to feed ingredient prices in recent years:

- Increased production costs of inputs.

- Inflationary scenarios.

- Climate changes that impacted grain harvests.

- The COVID-19 pandemic.

- Soaring sea freight rates.

- Higher oil costs.

- The war between Russia and Ukraine.

- And the change in production dynamics affected by the African swine fever in China and South East Asia.

THE AMINO ACID MARKET

In recent years, the data analyses conducted by Agri Stats demonstrated more significant use of crystalline amino acids, such as valine and isoleucine, in broiler diets, mainly in companies outside Brazil and the United States.

The expansion of the inclusion of amino acids in these countries was forced due to higher feed ingredient prices compared to Brazil and the United States.

In addition to minimizing the high cost of protein sources and meeting the nutritional needs of animals, companies also sought to meet the

ideal protein concept and obtain better performance.

There was a reduction in the average crude protein in broiler feeds and an increase in the inclusion rate of the three main amino acids:

- Lysine.

- Methionine.

- Threonine.

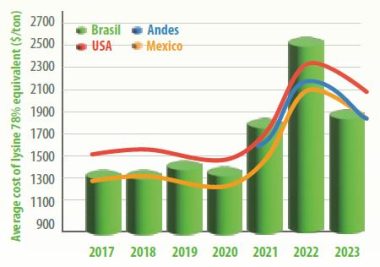

In 2017, lysine, with a 78% product concentration, cost US$ 1,300 per ton, and in 2022, its price reached more than US$ 2,500 in the Brazilian market (Graphic 4).

Source: Agri Stats

Methionine, with a 100% product concentration, began the historical series with prices of US$ 2,700 per ton, and its maximum value was US$3,400 in the United States (Graphic 5).

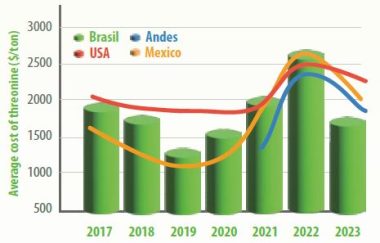

Finally, threonine, with a 98% product concentration, cost US$1,950 per ton in 2017, and in 2022, it reached its maximum value of US$ 2,652 per ton (Graphic 6).

Source: Agri Stats

It is interesting to note that the price evolution for the three main amino acids for broiler chickens had the same behavior in the four different regions analyzed: Brazil, the United States, the Andes Region, and Mexico.

The results observed demonstrated the need to monitor the movement of microingredients, mainly amino acids, which are not commodities but are priced globally in dollars and are imported.

Therefore, poultry and swine companies changed their purchasing behavior by searching for other suppliers on the market and working with more flexible purchase contract times for these amino acids.

PHOSPHATE AND FEED ADDITIVES

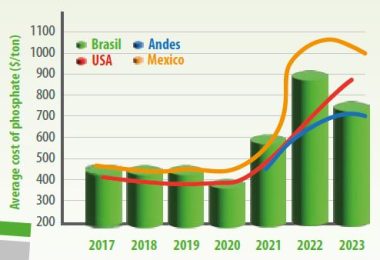

Another critical component of broiler diets that can be highlighted is the cost of phosphate (Graphic 7).

Source: Agri Stats

This mineral doubled in price from 2017 to 2022 in all regions analyzed in this competitive benchmarking study. Agri Stats also analyzed that companies made greater use of enzymes and enzyme blends, mainly phytase, even in the concept of superdose, to promote greater use of phosphorus and minimize the high nutritional cost of the formulations.

Animal nutritionists in the Americas had to develop strategies that minimized their high formulation costs, as the negotiating margin when purchasing inputs became tight in recent years. Greater optimization of nutritional levels for broiler chickens, spending on additives and extra ingredients in the formulation.

Additionally, changes in the amount of feed offered in each feeding phase of the broiler’s life have become critical approaches in the competitiveness of the feed cost formulas.

For additional information of Broiler and Swine international markets, please contact José Guilherme at [email protected]